how much does a tax advocate cost

Ad Search For Info About How much does a tax attorney cost. We make a difference in peoples.

Cpa Vs Tax Attorney Top 10 Differences With Infographics

The Board of Elections put the cost of running the contest at 15 million.

. BBB Accredited A Rating - Free Consult. Tax relief professionals charge fees for their services. The average fee to prepare a nonspecific Form 1040 in 2020 was 220 according to the National Society of Accountants.

Ad End Your IRS Tax Problems. We protect the rights of every taxpayer who comes to us and advocate on behalf of all taxpayers by working to simplify and reduce the burden of the tax code. We have at least one local taxpayer advocate office in every state the District of Columbia and Puerto Rico.

Free Case Review Begin Online. Find Useful And Attractive Results. BBB Accredited A Rating - Free Consult.

Discover Compare The Best Options For Your Search. Hourly services can cost you around 75 on average. Whatever You Need Find it on Bark.

The way they calculate and assess these fees vary widely by organization as noted below. End Your IRS Tax Problems - Free Consult. You can also call the.

There is at least one Local Taxpayer Advocate in each state as well as in Puerto Rico and the District of Columbia. What is a Tax Advocate for. Frequently Asked Questions on How Much Does A Tax Lawyer Cost in 2022.

Waiting since I25 have. Can the help find out info about refunds. Ad Find 100s of Local Tax Accountants.

Connect With a Fidelity Advisor Today. How much does a tax advocate cost Wednesday June 8 2022 Edit. How much does it cost to buy tax software.

Ad BBB Accredited A Rating. You can call your advocate whose number is in your local directory. For an itemized 1040 form that fee goes up to 323.

Newly qualified chartered tax advisers CTAs can expect an annual salary of 26000 to 36000 possibly. Though CPA fees vary by location and expertise their tax services cost 174 per hour on average in 2020 and. Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals.

The rates have gone up over time though the rate has been largely unchanged since 1992. Hiring a private health care. You could be spending 500 or more on a monthly basis depending on the services you need.

How much does an Advocate cost. What do they do. How much does it cost to take a vacation.

Social Security tax rate. Ad Unsure if You Qualify for ERC. Time-based tax professional fee structure.

Ad Make Tax-Smart Investing Part of Your Tax Planning. How do I apply for a tax advocate. See If You Qualify For IRS Fresh Start Program.

Ad Search For How Much Does A Tax Attorney Cost. Ad End Your IRS Tax Problems. Federal payroll tax rates for 2022 are.

Talk to our skilled attorneys about the Employee Retention Credit.

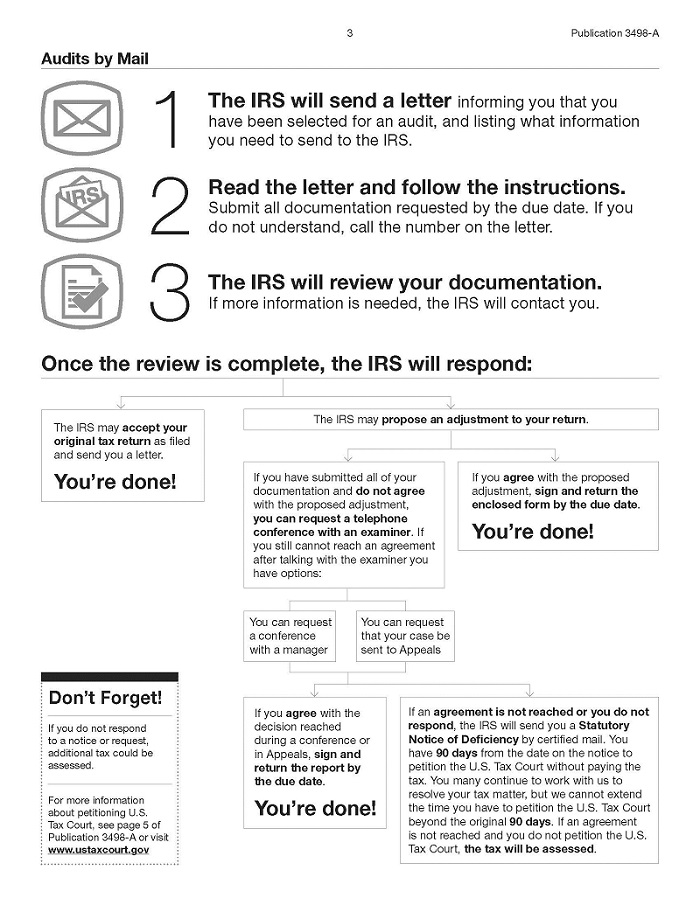

Audits By Mail Taxpayer Advocate Service

Taxpayer Advocate On Twitter Budgeting Employee Training Infographic

Home Tra Tax Relief Advocates Irs Taxes Business Tax Advocate

Everything You Need To Know About A Tax Attorney Turbotax Tax Tips Videos

![]()

Our Leadership The National Taxpayer Advocate Erin M Collins

How Much Does It Cost To Start An Llc Court Environmental Law Advocate

Irs Taxpayer Advocate Service Local Contact Hours Get Help

Low Income Taxpayer Clinics Litc Taxpayer Advocate Service

Benefits Of Gst Tax Advocate India Prevention Advocate 10 Things

Nta Blog Irs Deputy Commissioners Respond To Taxpayer Advocate Directive On Scanning Technology National Taxpayer Advocate Appeals Decision To Irs Commissioner Tas

This Infographic From The National Taxpayer Advocate Highlights Some Of The Most Serious Problems Faxing Taxpayers Today Tax Serious Problem Infographic Irs

3 Things To Do If You Are Arrested For A Criminal Charge Criminal Defense Lawyer Criminal Defense Criminal Defense Attorney

Chicago Tax Debt Tax Lawyer Tax Attorney Irs Taxes